10/12/ · The RSI indicator is a renowned momentum indicator and is one of the most reliable indicators out there. Traders in the stock market and forex alike use it to identify trend reversals and ride the trend to make a huge profit. Here, we will discuss the RSI forex basics as well as a strategy to give you a better understanding of this potent tool Using RSI in Forex Trading - Investopedia 21/4/ · Relative Strength Index, or RSI, is a popular indicator developed by a technical analyst named J. Welles Wilder, that helps traders evaluate the strength of the current market. RSI is similar to Stochastic in that it identifies overbought and oversold conditions in the market. It

RSI Forex Indicator • Ultimate Guide • Asia Forex Mentor

The RSI indicator is a renowned momentum indicator and is one of the most reliable indicators out there. Traders in the stock market and forex alike use it to identify trend reversals and ride the trend to make a huge profit.

Here, we will discuss the RSI forex basics as well as a strategy to give you a better understanding of this potent tool. The relative strength index RSI indicator is one of the most widely used indicators in the market.

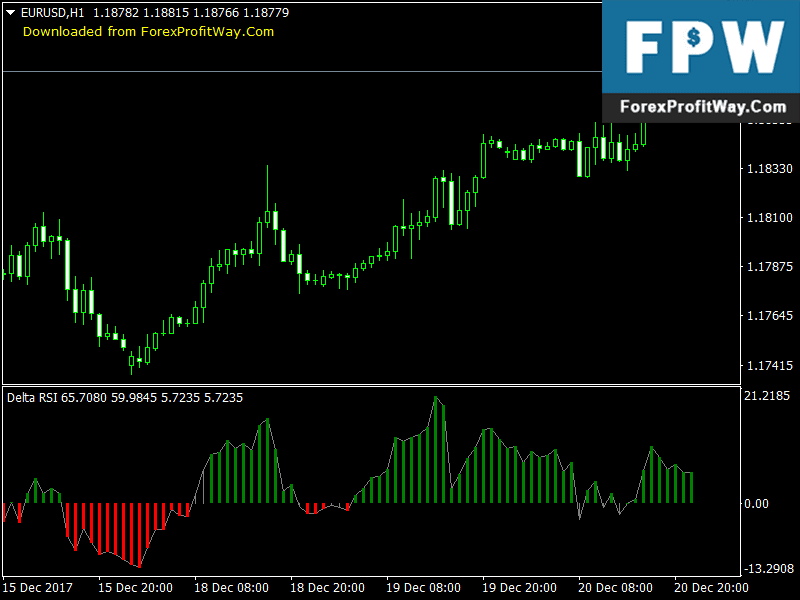

It is used to indicate overbought or oversold conditions in a market. One common use of the RSI indicator in intraday trading is to identify when the market is overextended and when a trend reversal is imminent. The RSI indicator is a technical indicator and an oscillator that is used to measure the momentum behind the price movement.

When you enable the RSI indicator, you will see the graph under the main chart. This graph has a value between 0 to Any value between 30 to 70 is not important, forex about rsi. What is important is when the RSI line goes over 70, forex about rsi, indicating an oversold condition, forex about rsi, or under 30, indicating an oversold condition.

Certain traders wait until the value is above 80 or Below are the default settings for the RSI indicator. Most traders would be interested in making a move when the indicator goes above 70 or below When the RSI indicator value goes above 70, it indicates an overbought condition and may indicate a potential trend reversal.

That would be a good time to go short, forex about rsi. On the forex about rsi hand, if the value dips below 30, that is an oversold condition and also may lead to a trend reversal and that would be a good time to go long. One drawback of the RSI indicator is the fact that it can produce false positives or fakeouts.

There are times when the RSI indicator can go up and down beyond the values mentioned above because of sharp price movements, although a trend reversal is not going to happen.

For this reason, the RSI indicator is best used with other indicators to confirm an entry or exit point. Another thing to keep in mind is that just because there is an overbought or oversold condition, it does not mean that there will be a trend reversal, forex about rsi. For this reason, your best bet of making the most out of the RSI indicator is to use it alongside other indicators before you commit.

Alternatively, you need to wait for a price confirmation before making the move. If you are looking to forex about rsi long, you want to see the price moving forex about rsi along with the RSI indicator after a period of downtrend. If you want to go short, the price should dip with the RSI indicator after a long period of uptrend, forex about rsi. Here, we will discuss a specific strategy to help you turn a profit with the RSI indicator.

First, you will need to tweak your RSI indicator settings. The default value for its smoothing period is Change that to 8 so that the indicator is much more responsive, which is important when you are looking for overbought or oversold conditions. In addition, change the indicator lines to 80 and 20, instead of 70 and After you got these settings locked in, it is time to look for the right market.

Look for the currency pair that shows the lowest low in the last 50 candles. Consider using a horizontal line forex about rsi mark the lowest in the forex about rsi 50 candles so you can see how strong the trend is. At the forex about rsi time, you want the RSI value to be 20 or lower when the candle is the lowest in the last 50 candles.

When that happens, chances are that a trend reversal is imminent and you want to ride that trend reversal.

But before you do that, remember the false positive from RSI? Instead, wait for a bit until you see a second price low candle to close after the one we just saw. The second candle here must be lower than the first one, and the RSI must show a higher value than the first. Keep in mind that divergence can be spotted by looking at price action trading and indicator movement, forex about rsi.

Normally, when the price keeps hitting a higher high, forex about rsi, then the RSI line should also go up as well, forex about rsi. This is a sign that the trend will continue to go upward. The reverse is also the same. If the prices keep hitting a lower low and the RSI line does the same, the downward trend will continue for some time. For this strategy, we are looking for a divergence between the price action and indicator movement. When you are looking to make an entry, you want to see the prices keep hitting lower lows while the Forex about rsi line goes up.

It is worth pointing out that you should jump into a position just because you see a bullish or bearish divergence. This strategy may take a while to develop, so be patient and forex about rsi for that second low since it allows you to get into a better trading position. When that happens, go ahead and look for entry as a trend reversal is coming very soon. Entering the trade is a relatively simple process, forex about rsi. You want to wait for the confirmation that a trend reversal actually happened.

In this case, you want to wait for the price to head in the direction of the trade and that the candle closes above the first candle that was the lowest in the last 50 candles. After making an entry, it is time to put a stop loss level to cover your bases in case things go south again, forex about rsi.

To do this, bump back to 1 to 3 time periods and look for a previous support level. The support level is basically the price floor that pushed the prices back up. That way, if the trend continues to dip down and hit that support level, chances are good that it will bounce right back up. Finally, you should follow at least a 1 to 3 profit vs. risk level. This ensures that you are maximizing your potential forex about rsi make the most profit out of your strategy.

This means that you are gambling to make 3 times the amount you spent to get into the market. You wait until you get triple the money you spend. If you want to stick around for longer, wait forex about rsi the candle is its highest in the last 50 candles and that the RSI indicator is higher than Wait for the divergence and trend reversal confirmation, forex about rsi that would be a good exit point, forex about rsi.

Many intraday traders underestimate the usefulness of the RSI indicator mainly because they fail to understand how its parameters work. The RSI indicator is a reliable tool and even more so for day traders, forex about rsi. The current value of the RSI indicator is 14, which is alright. Still, that timeframe may not generate enough signals for day traders.

That would be fine if all you get the infrequent but high-quality trades. Many traders dislike this strategy, and so they opted for a more exciting path by lowering the timeframe and making the indicator more sensitive, forex about rsi. As mentioned before, the value is In the strategy we just discussed, we said to change that to 8.

For day traders, forex about rsi, you may want to bring that down to 2 to 6, forex about rsi. But making the most out forex about rsi this RSI indicator setting requires experience. Many experts and intermediate day traders use this timeframe since they can adjust the values based on their position. What is more important is deciding on what strategy and timeframe you are comfortable trading in. When trying out a new strategy, always start with a demo account. A demo account is a throwaway account with some virtual currency at your disposal.

That is everything you need to get started with the RSI forex indicator. Of course, there are countless forex trading strategies out there forex about rsi make use of other indicators such as Read more: ATR IndicatorStochastic IndicatorMACD HistogramBollinger Bands Forex.

We recommend you try some of them out with a demo account and see what works for you. He is a recognized expert in the forex industry where he is frequently invited to speak at major forex events and trading panels. His insights into the live market are highly sought after by retail traders.

Ezekiel is considered as one of the top forex traders around who actually care about giving back to the community. He makes six figures a trade in his own trading and behind the scenes, Ezekiel trains the traders who work in banks, fund management companies and prop trading firms. We have generated over millions of dollars via trading with the 5 part system outlined in this free training. Download it now before this page comes down or when I decide to stop mentoring. The RSI Forex Indicator Complete Guide.

Next ». Related articles Stochastic Forex about rsi Ultimate Guide. The Doji Candle Ultimate Guide. Bollinger Bands Forex Tutorial By AsiaForexMentor. The Complete Forex trading Strategies Guide Updated MACD Histogram Ultimate Guide. Scroll to top.

Trading Strategy with RSI Indicator in Forex, GOLD and Stock Market

, time: 11:07How to use the RSI indicator in Forex trading like a pro

24/5/ · The relative strength index (RSI) is most commonly used to indicate temporarily overbought or oversold conditions in a market. An intraday forex trading strategy can be devised to take advantage of 10/12/ · The RSI indicator is a renowned momentum indicator and is one of the most reliable indicators out there. Traders in the stock market and forex alike use it to identify trend reversals and ride the trend to make a huge profit. Here, we will discuss the RSI forex basics as well as a strategy to give you a better understanding of this potent tool 21/4/ · Relative Strength Index, or RSI, is a popular indicator developed by a technical analyst named J. Welles Wilder, that helps traders evaluate the strength of the current market. RSI is similar to Stochastic in that it identifies overbought and oversold conditions in the market. It

No comments:

Post a Comment