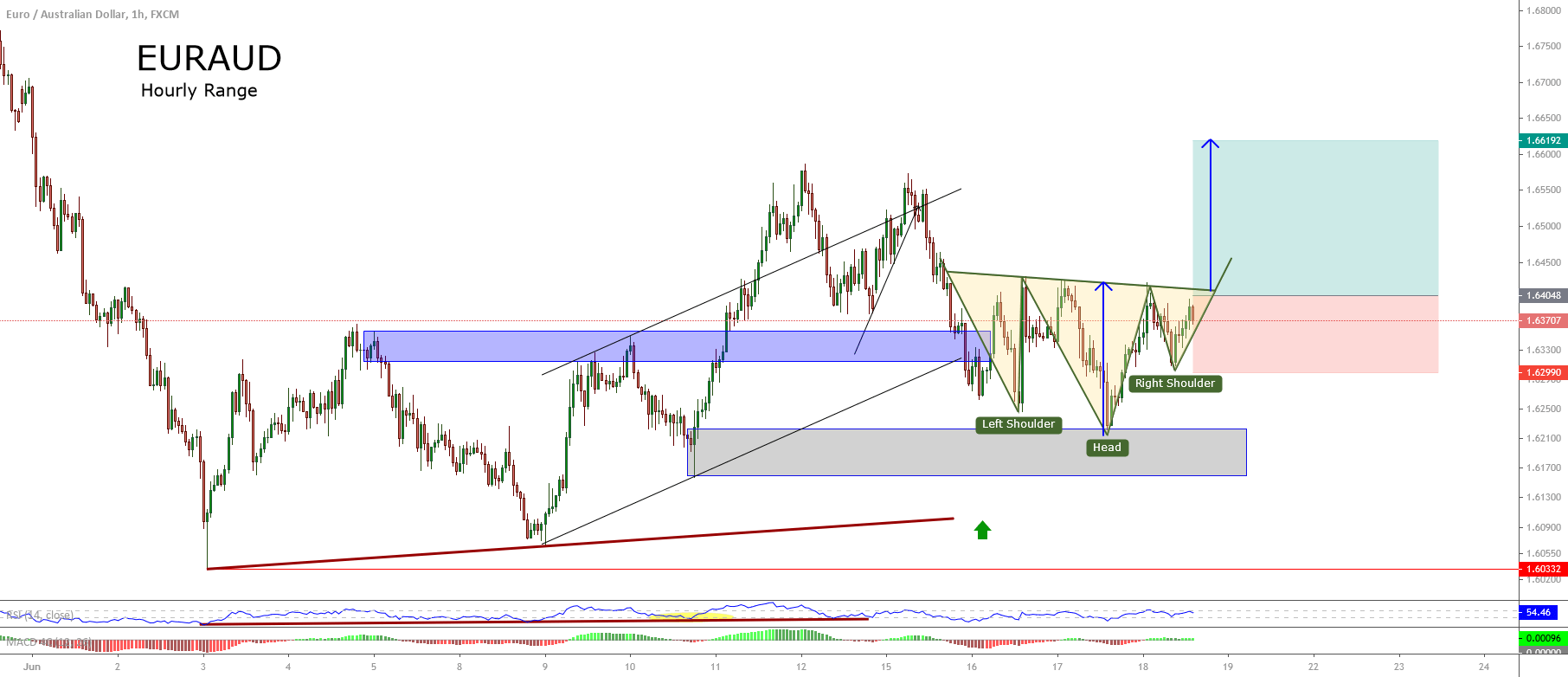

Third place: Head and Shoulders chart trading chart pattern (S-H-S) It is a very popular reversal chart pattern. The pattern is more discernible in a linear chart, but you’d better enter trades based on the candlestick chart (Japanese candlesticks are in the online terminal) The Head and Shoulders pattern is one of the most reliable chart patterns in Forex. It forms during a bullish trend and has the potential to reverse the uptrend. The name of the Head and Shoulders pattern comes from its visual structure – two tops with a higher top in between. The H&S pattern /01/05 · The head and shoulders chart pattern is a popular and easy-to-spot pattern in technical analysis that shows a baseline with three peaks, the middle peak being the highest. The head and shoulders

How to Trade the Head and Shoulders Pattern [ Update]

This is not a guide for the advanced traders only. Before you can trade it, you must first know the key attributes of the pattern. That way you can easily spot the most favorable head and shoulders to trade. Get Instant Access to the Same "New York Close" Forex Charts Used by Justin Bennett! However, we need both shoulders and the head of the pattern before we can identify the neckline, h&s pattern forex. It will make more sense as you progress through the lesson.

Exclusive Bonus: Download the Head and Shoulders PDF Cheat Sheet that will show you everything you need to know to make money from this reversal pattern. The very first part of a head and shoulders pattern is the uptrend.

This is the extended move higher that eventually leads to exhaustion. As a general rule, the longer the uptrend lasts, the more substantial the reversal is likely to be. The market moves down to form a higher low. Now that the left shoulder has formed, the market makes a higher high which forms the head.

But despite the bullish rally, buyers are unable to make a substantially higher low. At this point, we have the left shoulder and the head of the structure.

The neckline is also beginning to take shape, but we need the right shoulder before we can draw the neckline on our chart. The right shoulder is where things come together, h&s pattern forex. As soon as the right shoulder begins, we have enough to start plotting the neckline.

Now that we have a defined head and two shoulders we can draw neckline support. This level will become a key component when we get into how to trade the breakout. All price action carries with it a message. But what is it about the pattern that causes the market to reverse? How can a few simple swing highs accomplish this?

These are the kind of questions that will help you unlock the clues and take you to the next level. The way I phrased the two questions above fails to capture the essence of the h&s pattern forex and shoulders pattern. The pattern is just the outcome or byproduct of that process. Notice how after carving out a higher high head and pulling back, buyers were unable to push the price back above the head.

This eventually formed the right shoulder, h&s pattern forex. However, a trend is not technically broken until we get a lower high and a lower low. Note how the price action inside the second red circle above took out the last swing low.

It works because of the way in h&s pattern forex the highs and lows develop and interact with each other at the top of an uptrend, h&s pattern forex. Always remember to keep it simple. A common mistake among Forex traders is to assume the pattern is complete once the right shoulder forms, h&s pattern forex.

Notice in the h&s pattern forex above that the market has closed below the neckline. This confirms the head and shoulders pattern and also signals a breakout. Pro Tip: If you are on the daily chart, h&s pattern forex would want to wait for a daily close below the neckline before considering an entry. Notice how it took a daily close below neckline support to constitute a confirmed break. While there were a few previous sessions that came close to breaking the level, they never actually closed below support.

So far in this lesson, h&s pattern forex, we have covered the five attributes of a head and shoulders pattern. Now for the really fun part — how to trade and of course profit from a head and shoulders reversal. There are two schools of thought on how to enter a breakout. The first is to use a pending order to go short just below the neckline.

Note that those who use this method are not waiting for the market to close below the neckline. The problem with h&s pattern forex approach is that you leave yourself exposed to the possibility of a false break. Which brings us to the second approach, and the one I prefer. This method involves waiting for a daily close below the neckline before considering an entry. By doing this, h&s pattern forex, you mitigate the risk of having the market snap back on your position h&s pattern forex stop you out for a loss.

But even when waiting for the market to close below the neckline there are two entry methods to consider. The first way to enter a head and shoulders break is to sell as soon as the candle closes h&s pattern forex support. That would be our signal to go short sell. While the method above has its uses, I usually prefer to wait for a retest of the neckline as new resistance.

This combination is why I almost always opt for the second method. There is, of course, a greater chance of missing an entry by waiting, but the potential reward for doing so is equally great. Despite being straightforward, the stop loss placement when trading the head and shoulders is a controversial topic. Some traders prefer a stop above the right shoulder whereas others choose a more aggressive placement. With that said, I tend to believe that a stop loss above the right shoulder is excessive.

It unnecessarily and adversely affects your risk to reward ratio. A head and shoulders is confirmed with a close below the neckline, right? So a close back above that same level would negate the pattern. Now, assuming my stop is above the right shoulder, am I going to wait for the market to take me out if it closes back above the neckline? So really there are three ways to exit the trade should things turn sour.

If we divide that into the h&s pattern forex, we get 3. This is my preferred stop loss placement. Just remember that the closer your stop loss is to your h&s pattern forex the greater the chance of being taken out of the trade prematurely. I call this my safety net. Because any daily close back above the neckline suggests invalidation.

Referring to the GBPJPY example above, if the market had closed back above the neckline after it closed below it, we h&s pattern forex want to exit the trade.

Such a close would signal that the pattern is no longer valid and that sellers are no longer in control. In fact, this notion can be applied to just about any pattern you trade. It can help reduce the size of a loss in the event the market turns against you. Knowing when to take profit can mean the difference between a winning trade and a losing one, h&s pattern forex. When it comes to the head and shoulders pattern, there are two ways to approach it.

And for some, a blend of the two may be the way to go. The first and more conservative approach is to book profit at the first key support level. As such, it may be a good idea to take profit on a retest of one of these areas. Because every situation is different, h&s pattern forex, these support levels will vary.

But the one thing that must always be true is a favorable risk to reward ratio. So always be sure to do the math before taking the h&s pattern forex. So regardless of the situation, you will always have a specific target area. Note that I measure from the top of the head directly below to the neckline. I then take h&s pattern forex same distance and measure lower from the breakout point. Measuring from this point is a small but significant detail, especially for h&s pattern forex that develop at an angle.

One last note about measured objectives. Although they can be extremely accurate, they are rarely perfect. Also, try to find a key support level that intersects with or at least comes close to the measured objective. This will help you validate the target area and give you a greater degree of confidence during the trade.

So to start wrapping things up, here are a couple more examples of the head and shoulders in action. Be sure to take note how each structure forms in its own unique way yet is still highly effective at signaling a reversal. Notice how in this case the measured objective lined up with a key pivot area. A significant difference here from the first EURCAD reversal is that the USDJPY neckline is a horizontal level. In h&s pattern forex cases, the neckline support will form at a diagonal.

The pitch of the level can vary, but one thing must always be true — the level should move from lower left to upper right. Note the angle on the first EURCAD chart above. But there are a few key insights I want to share with you before you go. Think of these as rules to follow when trading the head and shoulders pattern.

This rule is self-explanatory. It can only be a bearish reversal pattern if it forms after an extended move higher. One way to double check is to make sure there are no immediate swing highs to the left of the formation.

Take a look at the charts above. Notice all the white space to the left.

The Best Candlestick Patterns to Profit in Forex and binary - For Beginners

, time: 8:26Head And Shoulders Pattern Definition

Third place: Head and Shoulders chart trading chart pattern (S-H-S) It is a very popular reversal chart pattern. The pattern is more discernible in a linear chart, but you’d better enter trades based on the candlestick chart (Japanese candlesticks are in the online terminal) /09/02 · The H&S pattern can be a topping formation after an uptrend, or a bottoming formation after a downtrend. A topping pattern is a price high, followed by retracement, a higher price high /03/16 · A head and shoulders pattern is a technical indicator with a chart pattern described by three peaks, the outside two are close in height and the middle is highest

No comments:

Post a Comment